An analyst who continues to construct a following with macro crypto calls believes Bitcoin (BTC) is sort of able to enter the parabolic stage of its market cycle.

Pseudonymous analyst TechDev tells his 490,300 followers on the social media platform X that Bitcoin is flashing technical indicators that preceded steep rallies previously.

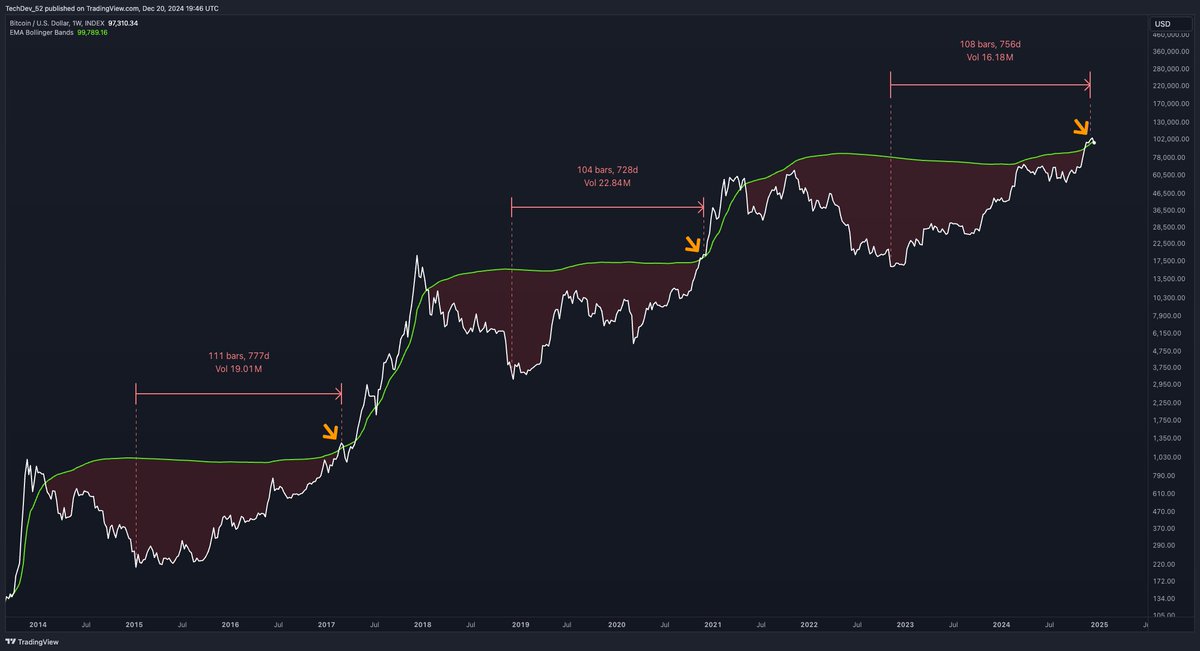

The dealer shares a chart suggesting that Bitcoin has breached the higher vary of its Bollinger Bands within the two-month time-frame after spending about two years recovering from a bear market backside.

Merchants use Bollinger Bands to determine potential intervals of volatility enlargement and decide whether or not an asset is overbought or oversold.

TechDev’s chart additionally means that the 2 indicators had been current in the course of the 2016 and 2020 market cycles – simply earlier than BTC ignited parabolic surges.

“That is the place issues have gotten thrilling.”

Taking a look at BTC from a distinct perspective, TechDev says Bitcoin is within the early levels of a parabolic ascent based mostly on the crypto king’s logarithmic transferring common convergence divergence (LMACD) indicator. The LMACD indicator is designed to disclose modifications in an asset’s development, power and momentum.

“Listening to the excessive time frames (HTFs) presents the very best probability to commerce the cycles.

$30,000 was not the highest, as a result of HTF enlargement had not ended.

$50,000 was not the highest, as a result of HTF enlargement had not ended.

$70,000 was not the highest, as a result of HTF enlargement had not ended.

$90,000 was not the highest, as a result of HTF enlargement had not ended.

And HTF enlargement nonetheless has not ended.”

Based mostly on the dealer’s chart, he appears to recommend that Bitcoin is not going to witness a cycle high till the LMACD on the two-month chart hits its resistance at 0.12. BTC’s LMACD seems to be at present hovering at 0.04.

At time of writing, Bitcoin is buying and selling for $97,274.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Value Motion

Observe us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses it’s possible you’ll incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney