Bitcoin worth edged decrease on Thursday regardless of optimism in wider markets on the again of the Fed’s rate of interest resolution. The flagship cryptocurrency has been consolidating above the vital stage of $42,000 after briefly topping $44,000, its highest stage in 20 months. Bitcoin was buying and selling 0.71% decrease at $42,569 at press time. BTC’s complete market cap has elevated by greater than 3% during the last day to $832 billion, whereas the overall quantity of the asset traded over the identical interval jumped by 22%.

Financial Outlook

Bitcoin worth has been buying and selling sideways over the previous few days, suggesting a pause in its current rally in the direction of $45,000. The premier cryptocurrency has decreased by 4% prior to now week however stays 15.22% larger within the month to this point. The digital asset has staged a big restoration this 12 months after a torrid 2022 during which a string of scandals, together with the collapse of FTX, led to a market meltdown, undermining the credibility of the sector.

The crypto market has been buoyed by the Fed’s newest rate of interest resolution. The US Federal Reserve on Wednesday held its key rate of interest unchanged for the third consecutive time, according to market expectations. With the easing of the inflation price, members of the Federal Open Market Committee (FOMC) voted to maintain the benchmark in a single day borrowing price in a focused vary between 5.25%-5.5%.

Moreover, the central financial institution indicated that three price cuts may very well be carried out subsequent 12 months. Additional price cuts are anticipated all through 2025 and 2026. Whereas the speed cuts will make the danger property extra engaging, analysts have famous that crypto market situations are nonetheless removed from the place they had been in 2021. Elsewhere, the European Central Financial institution (ECB) and the Financial institution of England (BoE) are set to announce rate of interest choices this week.

Bitcoin Worth Evaluation

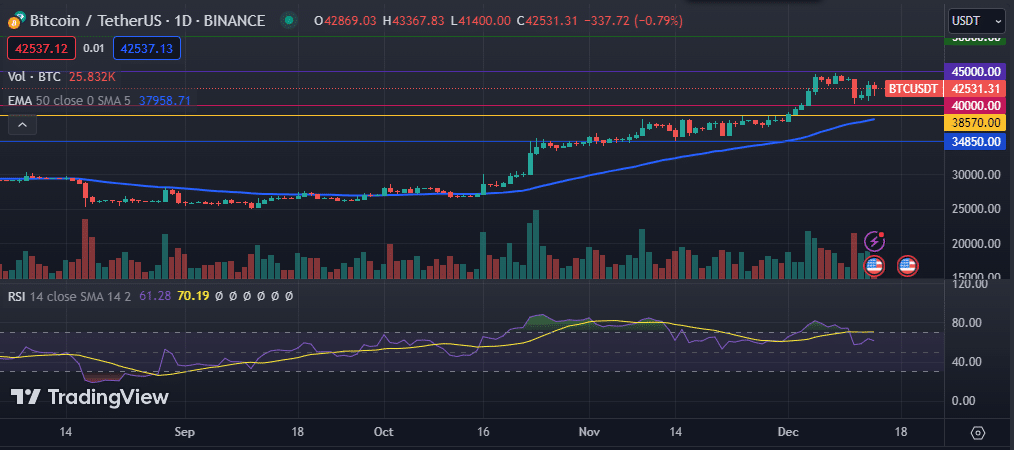

The every day chart reveals that the Bitcoin worth has been consolidating, suggesting exhaustion from its current rally. Even so, Bitcoin has remained above the vital $42,000 stage, flipping the $40,000 stage right into a assist zone. The digital forex stays above the 50-day and 200-day exponential transferring averages and the 100-day and 200-day easy transferring averages. Its Relative Power Index (RSI) has dropped under the sign line, highlighting cooling shopping for stress.

A breach above the psychological stage of $45,000 might immediate a contemporary upward for Bitcoin worth to the extremely coveted resistance stage of $50,000. Nonetheless, a drop under the fast assist at $40,000 may push the value decrease to $38,570.

BTC Worth Chart