Cardano (ADA), the good contract platform, has been going through a tough patch just lately. Whereas the broader DeFi sector has seen an uptick in DEX volumes, Cardano’s Complete Worth Locked (TVL) has plummeted, elevating issues concerning the well being of its ecosystem.

Associated Studying

DeFi Exercise And NFT Market Hunch

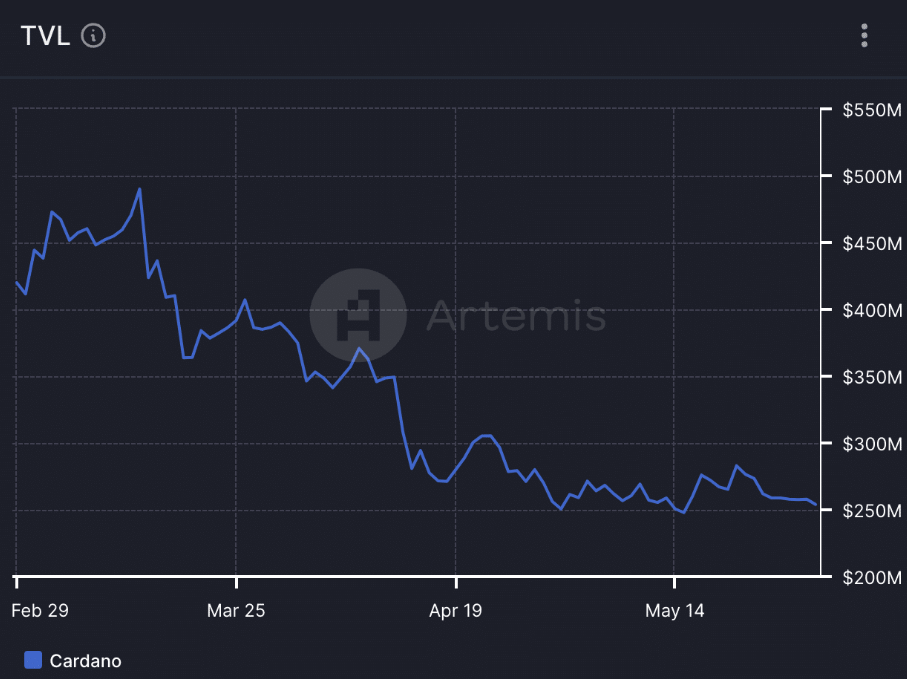

Regardless of the surge in DEX volumes throughout the crypto panorama, Cardano’s TVL has witnessed a major decline, dropping from $430 million to $230 million, in line with information from Artemis, a number one blockchain information supplier. This implies an absence of curiosity in dApps constructed on the Cardano community, probably hindering its long-term development prospects.

The NFT area on Cardano has additionally taken successful. Fashionable NFT collections have seen a dramatic lower in flooring value and total buying and selling quantity over the previous month. This waning curiosity in Cardano NFTs may additional dampen investor sentiment and negatively influence the value of ADA.

Cardano: Technical Indicators Flash Warning Indicators

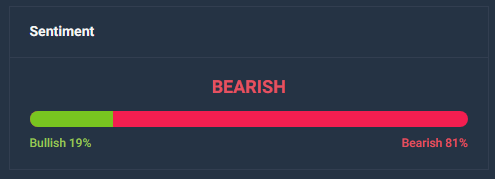

The technical outlook for ADA is presently bearish. The value has been trending downwards over the previous few weeks, forming a number of decrease lows and decrease highs. Moreover, key technical indicators just like the RSI (Relative Energy Index) and CMF (Chaikin Cash Movement) are pointing in direction of declining bullish momentum and cash circulate into ADA.

Past the quick value and DeFi woes, different components increase issues about Cardano’s future. The rate of ADA, indicating the frequency of token change, has fallen considerably, suggesting decreased buying and selling exercise. Moreover, the MVRV ratio, a measure of profitability for token holders, has additionally dropped, implying that almost all ADA addresses are presently underwater.

Cardano Value Forecast

Whereas Cardano stays a distinguished participant within the blockchain area, the current developments spotlight the challenges it faces. The mix of declining value, waning DeFi and NFT exercise, and destructive on-chain metrics suggests a possible for additional draw back within the quick time period.

Cardano is anticipated to expertise a modest enhance in value, reaching $0.47 by June 30, 2024, indicating a predicted rise of practically 5%. Nevertheless, it’s vital to think about varied technical indicators and market sentiment to evaluate the potential motion of the asset.

Associated Studying

The crypto’s bearish sentiment could also be influenced by components reminiscent of market traits, information occasions, or technical evaluation patterns. Moreover, the Worry & Greed Index stands at 73, indicating a state of Greed amongst market contributors. This implies that buyers could also be extra inclined to take dangers or interact in speculative conduct, which may probably influence Cardano’s value motion.

It’s noteworthy that ADA has skilled vital value fluctuations up to now. Its highest value of $3.10 was reached on September 2, 2021, marking its all-time excessive, whereas its lowest value of $0.017 was recorded on October 1, 2017, representing its all-time low. These historic value factors spotlight the volatility and potential for vital value swings inside the Cardano market.

Featured picture from ReddSparks Crypto Weblog, chart from TradingView