Este artículo también está disponible en español.

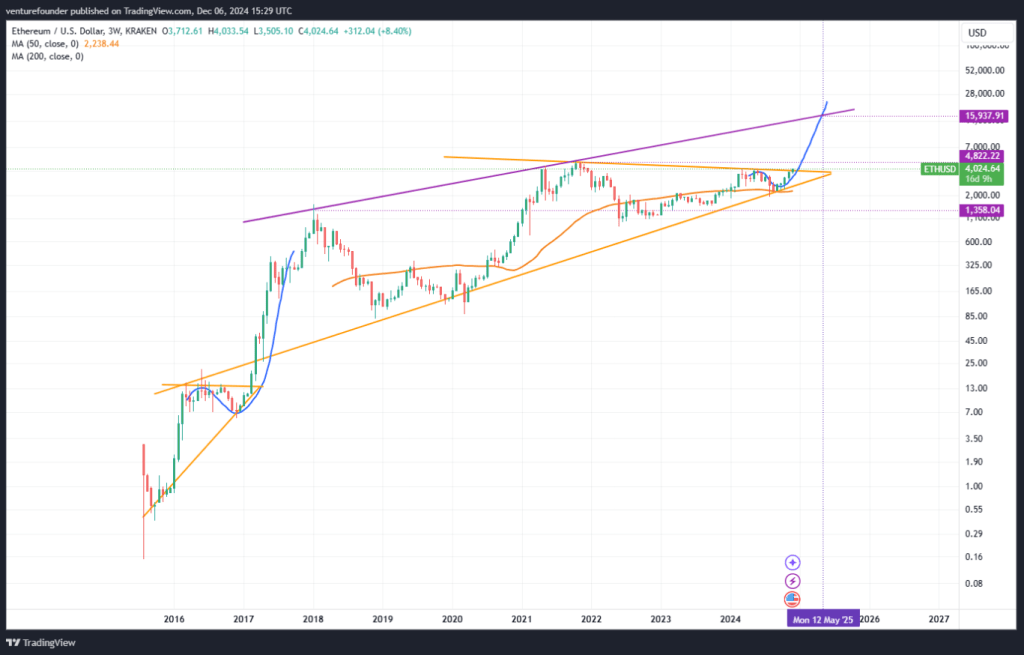

Ethereum (ETH) continues to spark bullish discuss within the cryptoverse, as well-known analysts see massive value strikes forward. In line with Enterprise Founder, Ethereum is forming a rising three-year triangle sample, which might set the stage for a doable breakout. Based mostly on comparable comparisons to knowledge from 2016-2017, the altcoin will hit $15,937, in all probability by Could of 2025.

Associated Studying

Such an increase would take Ethereum’s market capitalization past $1 trillion, a historic first for the blockchain behemoth. Analysts view a weekly shut above $3,800 as a major milestone. From there, Ethereum may goal for its all-time excessive of $4,878 earlier than shifting on to larger grounds. However is the market ready for this upswing?

This $ETH breakout out of the triangle consolidation could be very important.

Now #Ethereum solely has to shut this weekly candle bullish, and we might by no means revisit this sub $4,000 degree once more on this bull cycle.

The impulse transfer from 2016-2017 is repeating.

PT: $15,937 by Could 2025 pic.twitter.com/dNzcO3mPe1

— venturefounder (@venturefounder) December 6, 2024

Institutional Curiosity Drives Optimism

Extra establishments have gotten inquisitive about Ethereum, which makes individuals extra optimistic about its long-term prospects. Spot Bitcoin ETFs acquired a variety of consideration in the beginning of the 12 months, and now Ethereum-based funds are following go well with.

Notably, for the reason that center of November, spot Ether ETFs have gotten greater than $1.3 billion in recent inflows. The iShares Ethereum Belief from BlackRock has made probably the most returns, $500 million in only one week.

Past simply numbers, these investments present a rising belief within the Ethereum ecosystem. In line with analysts, this institutional funding stream will pave the best way for ETH’s anticipated meteoric rise. With institutional buyers persevering with to pour cash into the cryptocurrency, Ethereum’s worth proposition as a long-term funding seems stronger than ever.

Technical Indicators And Forecast

The current weeks’ value habits of Ethereum has additionally been quite favorable. Following a bit setback, the altcoin has recovered, climbing 30% beginning in November 18. With analysts underlining its resilience in opposition to market swings, it’s buying and selling at $3,686 proper now, which is a strong determine.

Technical markers of consolidation level to ETH preparing for its subsequent motion. Shifting averages present stability, therefore the Relative Power Index (RSI) stays impartial. Forecasts present ETH maybe rising by 43% in six months and 22% in three months, knowledge from CoinCheckup exhibits.

Associated Studying

Wanting Forward

The indicators level favorably although Ethereum’s route to succeed in $15,937 is undetermined. With favorable technical situations, institutional inflows, and robust ecosystem improvement, the altcoin is primed for main will increase.

Featured picture from INX, chart from TradingView