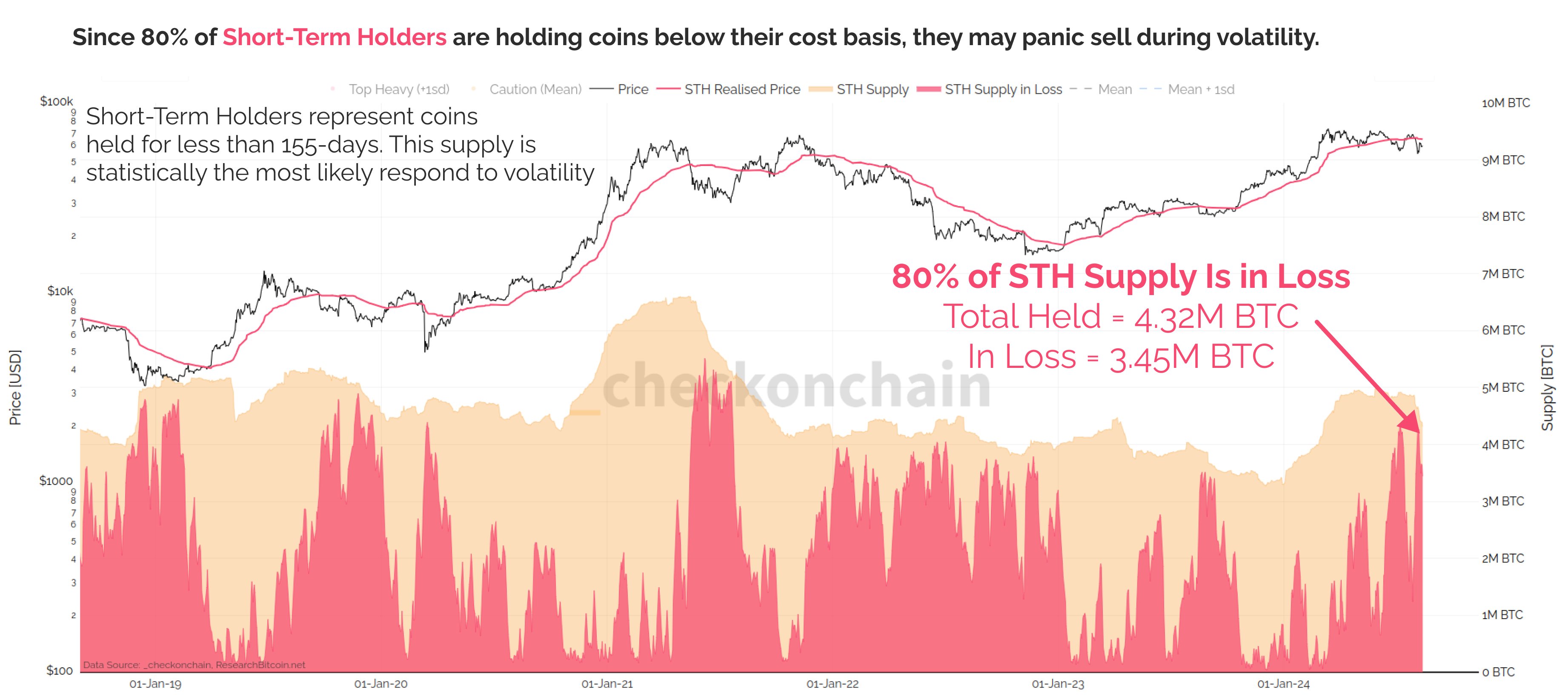

Greater than 80% of short-term Bitcoin holders are at the moment dropping cash on their BTC positions, in response to a preferred on-chain analyst.

The pseudonymous on-chain sleuth often called Checkmate tells his 97,000 followers on the social media platform X that the short-term holder (STH) metric appears to be like just like charts in 2018, 2019 and mid-2021, all of which signaled investor panic and incoming bearish tendencies.

The analyst defines STH as entities which have held their cash for lower than 155 days.

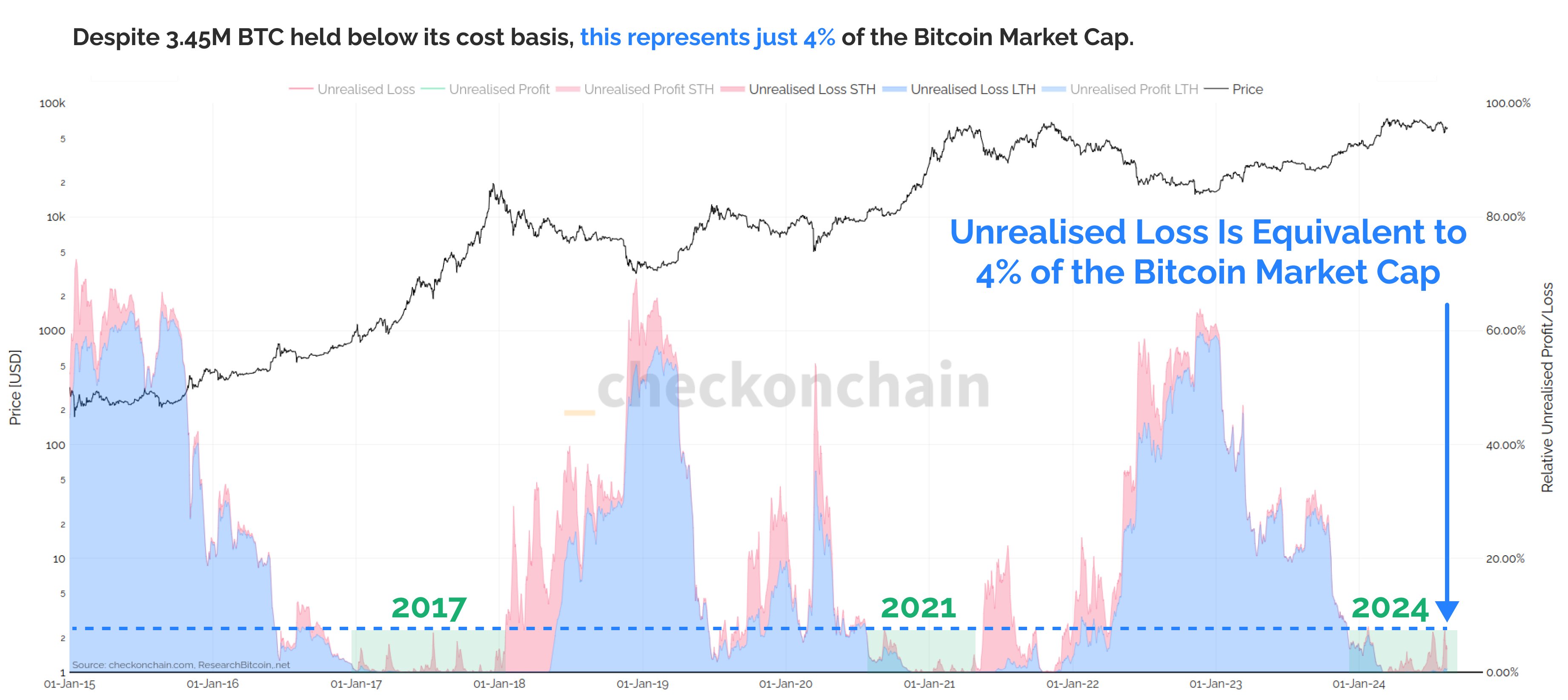

However the analyst says this time might be completely different as a result of whereas an enormous variety of short-term holders are within the pink, their value foundation shouldn’t be means beneath the present worth of BTC.

“Simply because a coin is held beneath its value foundation, it doesn’t inform us how dangerous it’s. Being underneath by -1% may be very completely different psychologically to being underneath by -20%. Regardless of 80% of STH cash being in loss, the magnitude of unrealized loss is simply 4% of the market cap.”

The pattern additionally seems restricted to short-term holders.

General, 81% of Bitcoin traders are earning money on the present BTC worth, in response to the crypto analytics agency IntoTheBlock.

Bitcoin is buying and selling at $60,438 at time of writing. The highest-ranked crypto asset by market cap is up greater than 3% prior to now 24 hours.

Checkmate additionally estimates that the typical worth to mine Bitcoin is at the moment round $57,200, indicating that miners are nonetheless making earnings at present ranges.

“I can solely think about miners are white-knuckling the present atmosphere, and barely worthwhile. For HODLers, that is largely irrelevant (and anticipated). For miners and shareholders… hope for a rally.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Observe us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses you might incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in internet online affiliate marketing.

Generated Picture: DALLE3